Key 1: Viewing your Stocks as a Business

"Investing is most intelligent when it is most businesslike.”

Benjamin Graham

I encourage my clients to think of their stock holdings not as a ticker symbol, bouncing up and down, but as a business they own. It’s a small business, and it’s generating wealth for you.

You bought your business because you believe in its longterm prospects. You measure the progress of your business through its profitability over time. You understand that some months, some years, will be better than others. If your business was a farm, you’d know there would be some years of drought and low yields—but also that there would be years of plenty too, and that over time, you’re likely to get a good result.

So, what is so helpful about viewing stocks as a business? There are two major benefits. First, it sets your focus on what matters—long-term business results. This perspective gives you a set of metrics to evaluate your investment separate from its daily trading price. Wouldn’t it be nice to know how your investment was performing separate from the daily ups and downs of the market? I’ll discuss this more in a moment.

The second benefit is that it sets expectation in a way that allows you to be happier. Having worked directly with several hundred high net-worth families and interacting with thousands more who were managing their own money, I can tell you I constantly see investors chasing unrealistic expectations and become unhappy when they’re not met. Perfectly intelligent people will ask for “Stocks with growth and income, but my portfolio value can’t drop.” Can you imagine owning a business and telling the CEO of your private business, “Grow this business, return capital to me, and make sure that nobody ever offers to buy my business for less than I paid for it.” That’s asking to control the uncontrollable.

If you’re going to own stocks, which are fractional pieces of an operating business, you must be prepared for wild swings in price. I would argue if you’re going to invest in the stock market at all you should be prepared to witness a 50 percent drop.

For a moment, imagine you own a private business. There is no price quote to check. How would we measure the performance of your business? In my view, we would want to measure two things: First, the annual return on investment. This would be measured by how much profit the business earned for you relative to how much you have invested. As an example, let’s say you invested $1 million into this business. Say that last year the company produced an after-tax profit of $50,000.

As the owner, your profit of $50,000 on an investment of $1 million represents a 5 percent rate of return. This 5 percent has nothing to do with stock price—this is a measure of business performance. Second, we’d track the profit growth rate. If the business earned $50,000 last year, you’d probably like to see more profit this year. Let’s say your business improves and you earn $53,000 this year. That means your business achieved profit growth of 6 percent. The significance of this growth rate is hard to overstate. It is widely followed and reported because in the long run, it determines changes in business valuation. Here’s an example: from 1960 to 2018, the S&P 500 grew its profits by 6.7 percent annually. So how did the price of the S&P 500 change? It grew by 6.5 percent annually. Profit growth and price growth are tied together— whether that’s upwards or downwards.

These same two metrics can be applied to your stock holdings—distinct from its current trading price. You can observe how much profit the companies produced on your behalf by taking the number of shares you own multiplied by the earnings per share. If you divide the resulting figure by how much you invested, you can see your return on investment. Second, you can look at the percentage growth in earnings per share. This allows you to track your profit growth rate.

Equipped with these tools, you can say goodbye to old thoughts like, “My stock is down 20 percent from where I bought last year. I made a terrible investment!” Instead, you can ask, “How has my investment performed from a business perspective?” This not only shifts your focus to the long term, it also makes your investing more businesslike.

What would this model of stocks-as-a-business look like if we applied it to owning a US index fund? You would own that fund because you believe in the long-term future of corporate America. You would measure progress by tracking the earnings growth of corporate America, which is to say its profitability over time. You would keep realistic expectations about the price of the index fund and the fundamentals of corporate America—understanding they will drop in value from time to time when we have a recession or, heaven forbid, even a depression. Finally, you would not check the price of your index fund every day or every week. Think of the time you’d save!

In the end, your portfolio is really just a tool for you to enjoy your life and your lifestyle. It’s a means to an end. If you’re checking it every day, you’re focusing too much on the tool. It becomes more of a burden than a blessing. It means you’re not spending time doing things that you enjoy with people you want to be with.

Check out my book Income on Demand on Amazon to build your financial castle.

Contact Us to learn more about how Farnam Financial can help you achieve your goals.

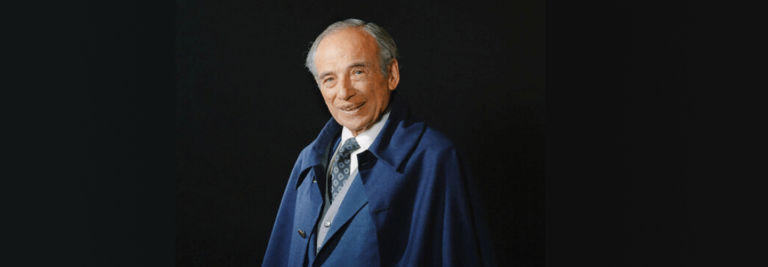

Jonathan Bird, CFP®

Farnam Financial LLC (“Farnam”) is a registered investment advisor offering advisory services in the State of Arizona and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Farnam in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Farnam, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to other parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.