“Learn from the mistakes of others. You can’t live long enough to make them all yourself.” — Eleanor Roosevelt.

While no two retirements are the same, the reality is that there are a handful of common mistakes and pitfalls to avoid when planning for retirement.

And, of course, while we’re more likely to learn from our own mistakes than the mistakes of others, the latter is a far cheaper option than the former. So, if you want to avoid some common retirement planning mistakes and save yourself money, stress, and, more importantly, time, here are the top four retirement planning mistakes to avoid:

Mistake #1: Procrastinating Retirement Planning

When it comes to retirement planning, the sooner you start, the easier it is.

But why is that? Let’s break it down.

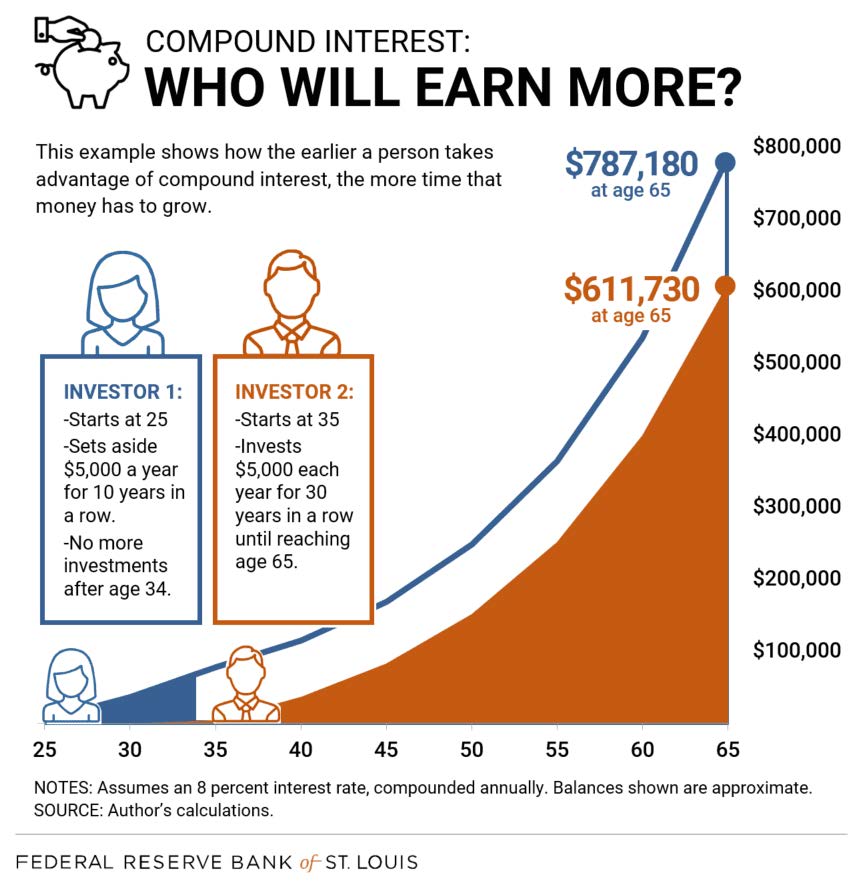

Compound interest is the most powerful force that exists in personal finance, and it rewards those who start early. That’s because compound interest grows your investments exponentially over time—in other words, the longer you are invested, the more powerful it becomes. It works by adding the interest you earn to your original investment and then earning interest on the new total.

So, you earn interest on your earned interest, creating a staggering compounding effect.

To understand the impacts of compounding, consider the following example of two investors:

- Investor 1, who starts early and invests $5,000 per year from age 25 to 35. Investing a total of $50,000 over 10 years.

- Investor 2, who starts later, investing $5,000 per year from age 35 to 65. Investing a total of $150,000 over 30 years.

Because of the staggering effects of compound interest and the power of starting early, the first investor ends up with 25% more at age 65, despite only investing $50,000 over 10 years—just one-third of the amount of the second investor.

Source: Federal Reserve Bank of St. Louis

That’s the power of starting early when it comes to retirement planning. If you start early, your funds have more time to compound and grow exponentially over time.

So, to avoid this common mistake, start investing today, even if it feels like a small amount. Remember, everything you invest today is more valuable than the same amount invested tomorrow. To get started, consider automating your savings where possible by setting up automatic contributions to your retirement or investment account.

And remember, retirement planning is a marathon, not a sprint. It’s about securing a future that brings peace of mind, security, and the freedom to enjoy life on your terms.

Mistake #2: Failing to Set Clear Retirement Goals

As an advisor that works exclusively with retirees, this is the number one mistake I see: failing to set clear retirement goals.

And it makes sense: nobody has firsthand experience with this abstract idea of retirement, so nobody knows exactly what they need to do to have a successful retirement. And that’s where clear retirement goals come in—they provide a detailed roadmap that guides you through one of the most significant transitions of your life.

Here are some examples of clear retirement goals you can create:

- Budget for Retirement: Within the next two months, draft a detailed annual retirement budget based on past expenditures and future plans, categorize fixed and variable expenses with a 10% margin for unexpected costs, and review it annually.

- Build Retirement Income Sources: Over the next 10 years, develop at least two additional income sources beyond Social Security, like retirement savings or rental properties, to cover 50% of annual retirement expenses.

- Grow your Net Worth: Select appropriate retirement accounts and investments to achieve a total return rate that outpaces inflation, aiming to reach your desired net worth by your target retirement age. This can be done through 401k contributions and IRA contributions and buying low-cost US-based index funds.

- Coordinate Income with Spending Needs: Starting two years before your expected retirement date, create and annually adjust a plan to match pre-tax retirement income with after-tax expenses.

- Optimize Social Security Benefits: Determine the optimal age and strategy for claiming Social Security benefits to maximize lifetime payout, considering factors like current health, longevity expectations, and current income needs.

- Travel During Retirement: Within the next three years, establish a dedicated savings plan specifically for travel, aiming to fund at least 10 major trips during retirement and regularly revisit travel goals and budgets based on evolving interests and health considerations.

Creating clear, achievable retirement goals will help you stay on track during your journey to a secure and comfortable retirement. With these in place, you can make informed decisions with confidence and focus on the steps necessary to achieve each goal.

Mistake #3: Underestimating Retirement Expenses

Next, one of the big mistakes I see retirees make is underestimating their retirement expenses.

This happens for a few reasons. First, while you may have a clear idea of when you want to retire, it’s impossible to know how long your retirement will last. Translation: you could live another 10 years in retirement or another 30 years, and your life expectancy has a major impact on how long your retirement savings will last, as each additional year means another year of income needed from your retirement income sources.

Next, because so few retirees have set clear goals for retirement, they’re unclear about what their lifestyle will be like in retirement. As a result, many fail to account for some of the big additional lifestyle expenses they will have, like luxury travel, fitness and wellness, purchasing a second home, and spending more on food and entertainment.

Finally, retirees tend to underestimate the total cost of healthcare in retirement, which according to AARP, is likely the single biggest expense that retirees will face. Of course, it’s easy to underestimate because, on average, new retirees are generally in good health, with low healthcare expenses, and they project the status quo onto the rest of their retirement. But, the reality is that health care costs can increase exponentially towards the end of retirement, often increasing dramatically in your 80s and beyond.

And in terms of retirement mistakes to avoid, this is the big one, as the best-case scenario of underestimating your retirement expenses could mean you have to adjust your spending and cut back in retirement, and the worst-case scenario could mean you run out of money during retirement.

So, to avoid this critical mistake, it’s essential to create and continuously update a retirement plan for your unique situation, complete with realistic estimates of your total expenses and income, as well as projections for healthcare, longevity, lifestyle, and more. That way, you can ensure you have enough saved to last throughout your retirement.

It’s also important to build in some flexibility, as well as make sure that you’re continuously reassessing your retirement plan so that any changes or unexpected costs can be addressed quickly and easily. Finally, it’s essential to remember that healthcare costs can change quickly, so it’s important to factor those in regularly and plan for the unexpected.

Taking these extra steps will help ensure that your retirement remains secure, no matter how long.

Mistake #4: Ignoring the Impact of Inflation and Taxes

Last but not least, it’s essential to recognize the impact of inflation and taxes on your retirement nest egg.

First, inflation is the gradual increase in the cost of goods and services over time. In other words, it’s the force that erodes the power of your money—it’s why movie tickets used to cost $0.75 in the 60s and are around $10 today. Inflation can really add up over time and have a huge impact on your retirement savings if you’re not prepared. To combat this gradual erosion, it’s essential to invest your retirement savings in a way that allows you to outpace the effects of inflation while also providing the income you need during retirement.

Second, taxes can have a major impact on your retirement nest egg, especially for retirees who have the majority of their investments in pre-tax accounts such as a traditional 401(k) or IRA. But, while you can’t avoid taxes altogether in retirement, there are specific tax planning strategies you can use to effectively lower your retirement tax bill, leaving more money to spend on the people and things you love.

Some of these retirement tax planning strategies include:

- Asset Location: holding certain assets in specific account types for tax benefits. (ie. placing your least tax-efficient investments in your most tax-advantaged accounts)

- Tax-efficient Withdrawal Strategies: taking income in a specific order from different buckets to optimize your tax liability each year.

- Capital Gains Harvesting: taking advantage of the 0% capital gains bracket each year during retirement to create tax-free income.

Ultimately, it’s critical to be aware of the impact that inflation and taxes can have on your retirement nest egg and plan accordingly. Without a proper plan in place, you could end up with less money than you need during retirement.

And in the end, you’ve worked hard for your retirement, and you deserve to enjoy it.

One of the best ways to do that is by avoiding these common retirement planning mistakes. So get started investing today, set your retirement goals, get clear about your expenses, and be sure to account for the impact of inflation and taxes in your retirement plan. By doing these things, you’ll be well on your way to a happy, healthy, and secure retirement for decades or more.