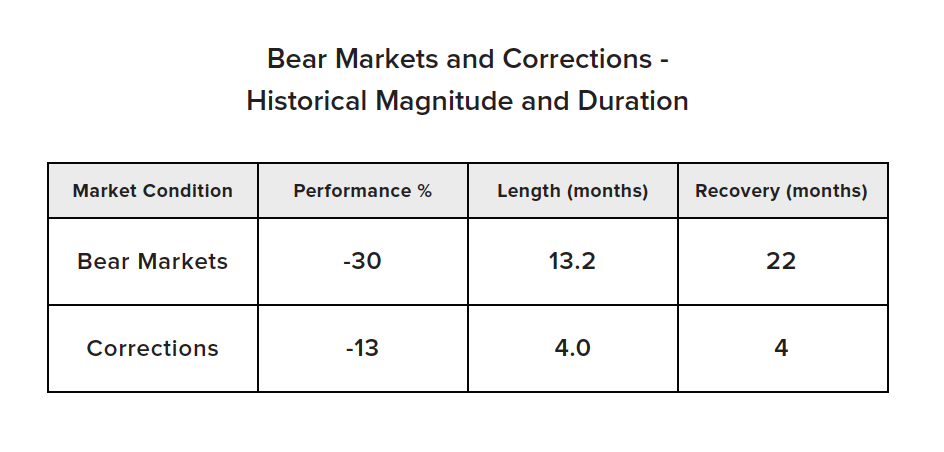

According to an analysis of the S&P 500 by CNBC, since World War II we’ve seen twenty-five market corrections. A correction is defined as a drop of 10 percent or more. The average correction has seen a 13 percent market drop, and on average takes four months from the bottom to recover.

A bear market, on the other hand, is a drop of 20 percent or more in market value. We’ve seen thirteen of those since World War II. The average loss in market value is 30 percent.

And the average duration: a bear market on average lasts thirteen months. That’s how long it takes to go from market top to market bottom. The recovery on average takes twenty-two months. That means from the market bottom it takes roughly two years to get back to the top. Put corrections and bear markets together and we’ve had thirty-seven “bad times” market punches in the mouth in the past seventy-four years.

It’s important to remember that historically, significant drops occur in the market every two years. While we’re invested in the market with the expectation of satisfactory long-term gains, we should keep our expectations low about what happens in the short-term. There will be all kinds of negative news that drives short-term price drops , so tune out the noise and stay focused on your long-term allocation.

Want to learn more about how to gain peace of mind with your investments?

Check out my book Income on Demand on Amazon to build your financial castle.

Contact Us to learn more about how Farnam Financial can help you achieve your goals.

Jonathan Bird, CFP®

Farnam Financial LLC (“Farnam”) is a registered investment advisor offering advisory services in the State of Arizona and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Farnam in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Farnam, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to other parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.