In December of 2007, Warren Buffett placed a million-dollar wager with Protégé Partners, a hedge fund investment firm. It was a classic hare versus tortoise showdown. Buffett bet on the tortoise, wagering that an S&P 500 index fund would outperform whatever five hedge funds Protégé Partners picked over a ten-year period. The winner would make a dramatic public point, and the money would go to charity.

Buffett acknowledged that Protégé Partners had the look of a winning hare. “This assembly is an elite crew loaded with brains, adrenaline, and confidence,” he wrote. Still, Buffett believed that the tortoise—a virtually cost-free, unmanaged S&P 500 index fund—would win the race. And that was something Buffett wanted everyone with money in the stock market to know.

“Addressing this question is of enormous importance,” he wrote to the shareholders of Berkshire in 2017, at the conclusion of the race. “American investors pay staggering sums annually to advisors, often incurring several layers of consequential costs. In the aggregate, do these investors get their money’s worth? Indeed, in the aggregate, do investors get anything for their outlays?”

The outcome of the race wasn’t close: Buffett and his tortoise took the prize. In the first year, 2008, the hedge funds outperformed the index fund. Fast off the starting line! But in each of the next nine years, the index fund prevailed. Its annual average gain was 8.5 percent; the best of the five hedge funds checked in at 6.5 percent, and the worst at 0.3 percent.

By 2017, the money Buffett and Protégé Partners laid on the table had grown well beyond a million dollars. The beneficiary: Buffett’s charity of choice, Girls Inc. of Omaha, with its $2.2 million windfall.

So Buffett bet on the market itself, not on the ability of very smart people to pick a handful of winners from the crowd. What’s more, hedge fund managers charge fees, big fees – typically 2 percent of your principal plus 20 percent of your annual profits. That tips the odds even further in favor of the index-fund-tortoise.

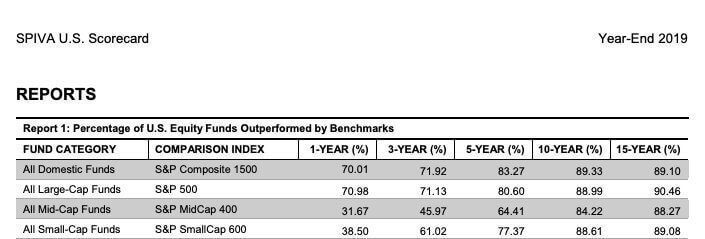

Still not convinced? Look at the long term record of professional managers against the S&P 500 as measured by Standard and Poor’s. Over the past 15 years, 9 out of 10 funds have underperformed.

Want to learn more about how passive investing in index funds can help you earn better returns and minimize your tax bill?

Check out my book Income on Demand on Amazon to build your financial castle.

Contact Us to learn more about how Farnam Financial can help you achieve your goals.

Jonathan Bird, CFP®

Farnam Financial LLC (“Farnam”) is a registered investment advisor offering advisory services in the State of Arizona and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Farnam in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Farnam, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to other parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.