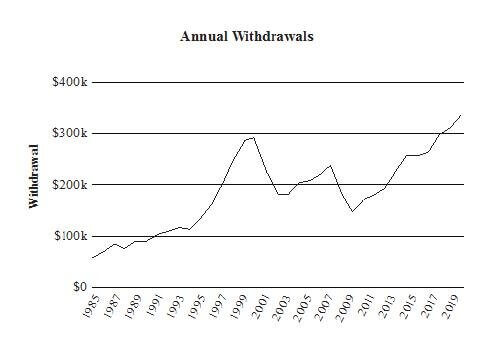

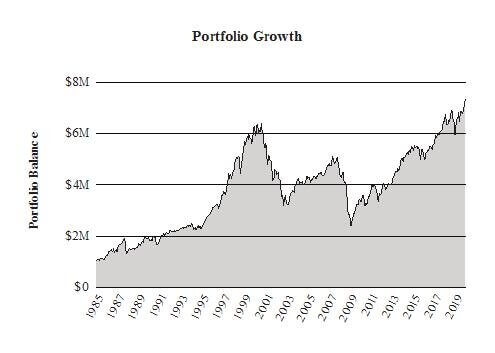

We can’t see what the future will bring—but we can learn from the past. One of my favorite websites is www.portfoliovisualizer. com. It provides a back-testing tool that lets you see how actual portfolios—and actual withdrawal rates—would have worked over any date range beginning as far back as 1985. I want to show you a purely hypothetical example for illustrative purposes only. If you retired then, at sixty-five, and utilized the income-on-demand strategy, where would you stand in 2019, at age ninety-nine? On the other side of a dot-com bust and the Great Recession?

We start with some assumptions. Let’s say the beginning portfolio balance is $1 million, invested entirely in Vanguard’s S&P 500 index fund. Let’s say you wanted income worth 5 percent of the portfolio’s value every year to help finance your hypothetical retirement.

The results are startling. Over those thirty-plus years, you’d have taken a total of $7,348,554 in income—and your ending portfolio balance would stand at $6,869,081. I’ll let the numbers speak for themselves in these charts.

Want to learn more about how to gain peace of mind with your investments?

Check out my book Income on Demand on Amazon to build your financial castle.

Contact Us to learn more about how Farnam Financial can help you achieve your goals.

Jonathan Bird, CFP®

Farnam Financial LLC (“Farnam”) is a registered investment advisor offering advisory services in the State of Arizona and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Farnam in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Farnam, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to other parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.