Tips for Investing a Personal Injury Settlement

For those who have been in the unfortunate situation of going through a personal injury case, the entire process can be both confusing and overwhelming. If you have reached resolution in a case and received a lump-sum payment or structured settlement, you should feel comfort and relief. However, you may be left with a brand new set of questions. Receiving a large sum of money all at once (in the case of a lump-sum payment) can change your life, but there are a number of steps you should take to ensure that you are setting yourself and your family up for success and peace of mind moving forward.

Understanding how personal injury payments work

A personal injury settlement is an agreement by which a person who has been injured comes to an agreement to dismiss a claim for damages in exchange for money. This can come in a few different forms, but the most common are a lump sum or a structured settlement, which is paid out as an annuity. Lump-sum payments are more common as they are generally the preferred option of insurance companies. This payment is often a significant, even life-changing amount of money. Without fully understanding the financial impact of receiving settlement money and carefully planning your next steps, you can run into some common pitfalls. Below, we will cover some of the do’s and don’ts when you have your settlement proceeds in hand.

How to invest personal injury settlement funds

-

- Put the money in the right place in the short term

When you receive your settlement, it will usually be paid by check to your attorney, who will pass it along to you. A common mistake that many people make it letting that money sit in your checking account. While it is good not to start moving the money until you have a plan, a checking account is not the best place to hold these funds. Since it is a significant amount of money, it should be in some type of income or interest-earning account. Another reason to move it from a savings or checking account is that the FDIC only insures up to $250,000 per account, leaving you exposed to fraud or losses. - Create an emergency fund

If you have not already created an emergency fund to cover unexpected expenses outside of your daily living expenses, this is a good first step. You should set aside 3-6 months of expenses in an interest-bearing account. This should be used for things like major house or vehicle repairs, unexpected medical expenses or any significant expense that has not been budgeted for. This fund should not be used for regular monthly expenses or discretionary spending. - Consult with a financial advisor

An investment advisor can help to create a plan to serve as your roadmap moving forward to ensure peace of mind for your financial future. A certified financial planner can help with defining your financial goals, tax planning, asset allocation, budgeting and advising on the decisions you will be making when investing your personal injury settlement. Be sure to ask the right questions when choosing an advisor to make sure that they are the right person to help you and your family achieve your financial goals. - Pay off debts (credit cards, student loans, mortgages)

Many people decide to immediately pay off all debts after receiving their settlement proceeds. This can be a relief for many and a mental victory. However, this is another area where an advisor can help to understand which debts make sense to pay off. For instance, high-interest credit cards make sense to pay off, but something like a low-interest mortgage may not make as much sense if those dollars can earn more than the interest percentage if invested. Weigh the benefits of paying off any debt before making these large financial decisions. - Leverage tax-advantaged accounts

One of the best tools you have for reducing your income tax burden is putting funds into tax-advantaged accounts. This will help to leave more money in your pocket when you pay taxes in the future, while still offering the same growth and benefits as other brokerage or investment accounts. - Create Passive Income Streams

Based on the type of settlement you receive, it will most likely be considered a reimbursement rather than income. However, you should consult with a financial planner before making investments as they will help with proper income planning. Furthermore, consulting with a tax professional can help ensure you understand the rules and don’t unintentionally pay more than necessary. - Donate to charity

After completing the process of receiving a lump-sum payment or structured settlement annuity, you will have more funds available than you have in the past. As you go through the process of budgeting and allocating funds, charitable giving can provide emotional benefits, tax advantages and satisfaction with the impact that you are making. We encourage this. However, it is important to ensure that you take the necessary steps first before determining how much to give.

- Put the money in the right place in the short term

Common pitfalls with personal injury settlements

Miscalculating your settlement proceeds

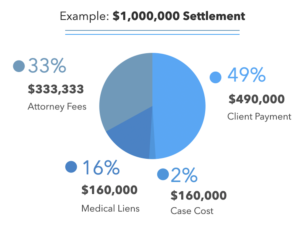

There are two big things to look out for when you receive a personal injury settlement. The first is fully understanding how much money you are actually receiving. There are a number of reasons that your take-home amount will be far less than the amount you received in your settlement.

Another very important consideration is the reimbursement or “set-aside” amount. An insurance company, doctor or hospital can issue a medical lien to recover the costs that they covered before you received your settlement payout. Reimbursing these funds will not only reduce the total amount of your settlement that you keep, but can also be a complex process that may lead to overpaying bills. Working with a lawyer and/or financial planner is a way to ensure that you fully understand these reimbursement payments and how best to manage the process.

Similarly, if you have a Medicare or Medicaid plan, you are required to set aside funds for any future medical bills that are incurred as a result of your personal physical injury or sickness. These funds can be allocated in ways that provide significant advantages to you. These include investing in treasury bills, which do not carry a state income tax burden, are sold to you at a discount on the redemption price and come without commission fees. Trust-like arrangements are another way to set aside these funds in a safe and advantageous manner. It is critical to avoid overly long-term or high-risk investments with your set aside funds.

Buying things that you otherwise wouldn’t

When receiving large sums of money, it can be very tempting to change your lifestyle or purchase things you normally wouldn’t. There is nothing wrong with this if it is done in an objective and strategic way. Just like before your settlement, purchase decisions should be made with a budget and financial plan in mind. Your discretionary spending may increase as part of your budget, but those decisions should be made before purchasing fancy cars, luxury items, or anything significantly different from your normal spending. The safest advice is to maintain the status quo in the short term, until you have adjusted your financial plan and budgets based on your evolving net worth.

Making illiquid or complex investments

Any time you are allocating your funds, it is important to maintain liquidity and avoid investing in anything that you don’t understand. This sounds simple. However, when determining where to invest funds, it’s fairly common for people to choose high-risk investments, complex assets that they don’t fully understand, or assets that cannot be easily sold and converted to cash. Before making any major financial decisions, ensure that you fully understand the details and ideally, consult a financial planner for advice.

Excessively gifting to family or friends

Similar to winning the lottery, when you receive settlement money, it can be surprising who comes out of the woodwork seeking gifts, loans, or investments. Create a plan for gifting and stick to it. These can be difficult decisions as there are often emotions involved, especially with family and friends. However, this is a very easy way to blow through settlement funds if it is not done in a calculated manner.

Summary

When you have completed the process of recovering from financial and emotional distress by being made whole from a personal injury, car accident, physical illness or other settlement claim, it is important to take a deep breath before making decisions. Following these steps will help you to properly plan and make wise decisions about what to do next. If you are in this position and have questions, feel free to reach out to us for a free consultation or simply to answer questions and provide guidance.